Understanding High Net Worth

UHNWIs signifies substantial financial assets, often held by individuals or households. These assets include liquid assets, valuable investments, properties, or businesses, elevating them well beyond average wealth levels. This status embodies financial stability, affluence, and the capability to make substantial contributions across sectors.

Exploring High-Net-Worth-Individuals

Who qualifies as a high-net-worth individual? HNWIs possess significant investable assets and strive to optimize their financial standing. Typically, they include business owners, medical professionals, or high-salary professionals like airline pilots.

Diving into UHNWIs

Your net worth encapsulates the total value of all assets. The criteria for ultra-high net worth evolve as more individuals attain millionaire and billionaire status. Presently, it is predominantly defined at a threshold of $30 million.

Quantifying UHNWIs:

Reports by Knight Frank identify 529,625 individuals with a net worth surpassing $30 million. The surge in billionaires has led Forbes to become a better gauge for (Ultra-High Net Worth Individuals), with 44 individuals surpassing $30 billion in June 2023.

Distinguishing HNWI from UHNWI

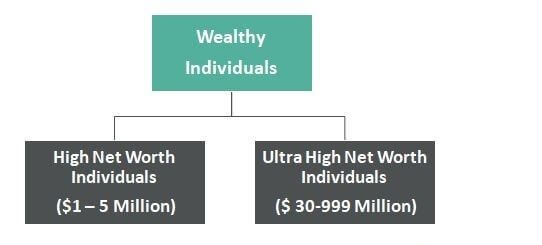

While subject to interpretation, HNWIs typically possess assets valued at a minimum of $1 million. In contrast, (Ultra-High Net Worth Individuals) are individuals whose assets surpass $30 million.

Understanding of UHNWIs (Ultra-High Net Worth Individuals): Empowering Financial Success

What is Wealth Management?

Wealth management isn’t just about finances; it’s a gateway to confident financial pursuits regardless of your status as a High Net Worth Individual (HNWI) or (Ultra-High Net Worth Individual).

Navigating Finances Without the Confusion

Managing money involves intricate elements like investments, taxes, estate planning, and retirement. For most, it is uncharted territory, making it risky and daunting without expert guidance.

The Importance of Expert Guidance

Having a wealth manager isn’t just about managing wealth; it’s about preventing financial setbacks. Their expertise aids in spotting potential issues before they jeopardize your portfolio.

Guidance Tailored to Your Wealth Status

Professionals specializing in managing wealth for high-net-worth and ultra-high-net-worth individuals offer crucial support and guidance in various financial scenarios.

Comprehensive UHNW Wealth Management

UHNW wealth management encompasses a spectrum of services that cater to distinct financial needs. These areas highlight the pivotal expertise a UHNW wealth manager offers:

Building a Strategic Portfolio: Strategically allocating assets for growth and wealth preservation is key. UHNWIs wealth managers curate bespoke investment strategies, blending traditional and alternative investments aligned with your risk tolerance and long-term goals.

Identifying & Mitigating Risks: Wealth brings greater exposure to risks. (Ultra-High Net Worth Individuals) managers identify, assess, and mitigate risks like market volatility, interest rate fluctuations, and personal risks such as health or tax-related issues.

Tax Planning: Efficient tax management is pivotal. (Ultra-High Net Worth Individuals) managers leverage strategies like tax-loss harvesting, income shifting, and trust utilization to minimize tax liabilities and optimize wealth growth.

Estate & Legacy Planning: Wealth to (Ultra-High Net Worth Individuals) means leaving a legacy. Managers ensure a smooth wealth transfer, minimizing estate taxes while safeguarding the impact on beneficiaries.

Philanthropic Planning: Many (Ultra-High Net Worth Individuals) aim to make a societal impact. Wealth managers aid in structuring impactful and tax-efficient philanthropic efforts through trusts or foundations.

Read More: Theinfotainers

Add comment